[Featured] What happens when a NFT project ends? Formula 1 ends its NFT Earn-2-Play Video Game

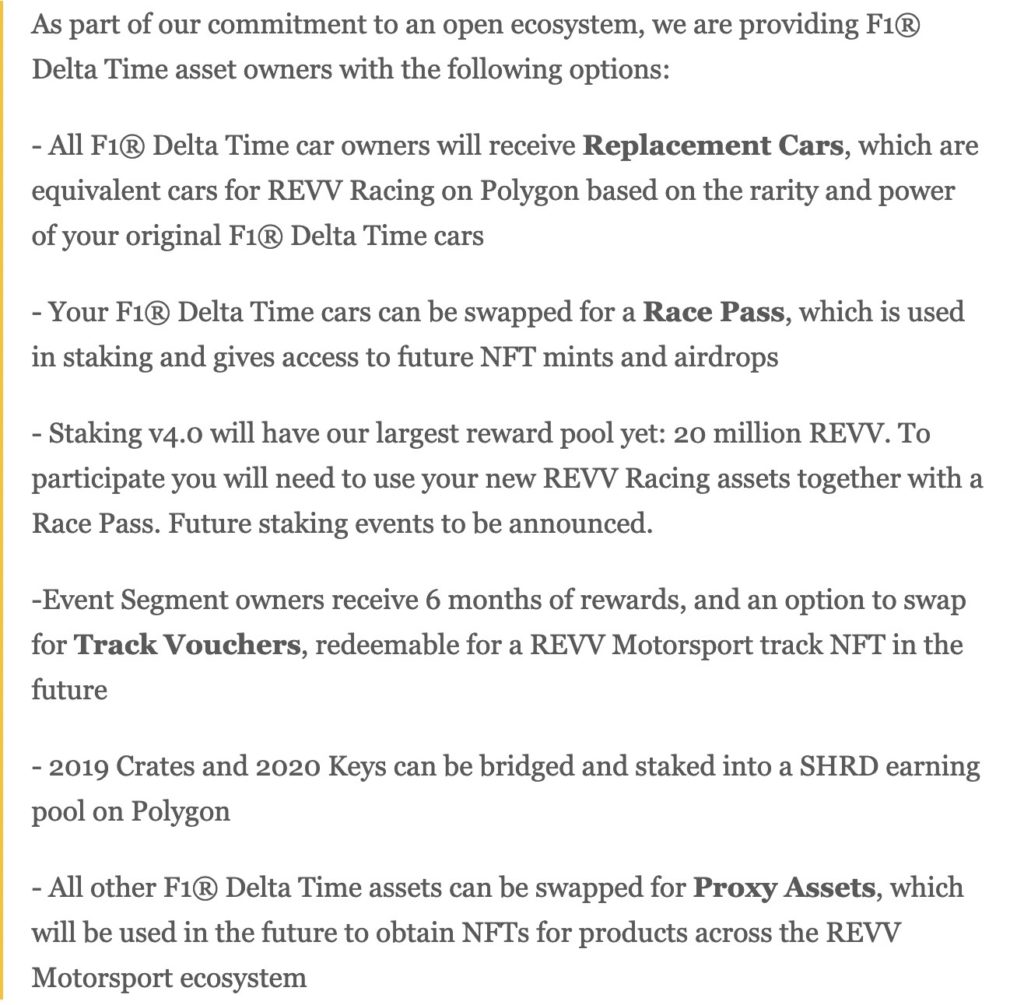

On March 16, 2022, the Formula 1-licensed non-fungible token (NFT) video game, F1 Delta Time, shut down. According to game developer Animoca Brands, Delta Time shut down because it could not renew the license with Formula 1. In a Twitter thread, game developer Animoca Brands announced they will give current NFT holders replacement NFTs for other Animoca Brand racing games. Animoca Brands has licensed racing games with Fédération Internationale de Motocyclisme’s (FIM) premier road racing series: MotoGP (MotoGP Ignition), and the premiere single seater electric car championships series: Formula E (Formula E: High Voltage) and its own non-licensed racing game: REVV Racing.

Delta Time, launched in 2019, was one of the first licensed NFT video games. The most expensive single NFT transaction sold in 2019 occurred in Delta Time, where a single NFT car sold for over $100,000. While Formula 1 Delta Time had the single highest NFT purchase price, it did not have significant trade volume. According to OpenSea, there were only about 1,800 unique wallets for Delta Time. In 2021, Formula 1 announced Crypto.com, a crypto-currency exchange application, as the inaugural title partner for the Formula 1 sprint series. Formula 1 and Crypto.com did not reveal the details of their partnership. Formula 1’s statements didn’t provide any evidence that Crypto.com was brought in to increase cryptocurrency trade volume.

Risk of Earn-2-Play Model

Formula 1 Delta Time was based on a play-2-earn model, where players earned in-game crypto-currencies and NFTs that could be traded for value outside of the game. Players use REVV tokens, which are used across Animoca Brand’s racing games, to purchase not just appearance changes or “skins” but also in-game mechanics, such as car components and tire types. The licensed shutdown means that the Delta Time NFTs have quickly deprecated in value, as they won’t be transferred or playable in another game. Animoca Brands has announced that they compensate players with replacement assets on the non-licensed REVV Racing Game. However, press releases do not state players will be compensated for their NFTs at the financial market rate. Because non-branded replacement assets have dramatically less market value than F1 branded assets, players have lost monetary value in the game transfer.

While NFTs offer unique opportunities for sports organizations, the Delta Time’s closure shows the potential risk of maintaining and ending an NFT project. Here are some other questions to consider when launching a NFT partnership:

Does your audience want NFTs or how many NFTs does your audience want?

Despite the public’s interest in the generalized NFT market, there is no guarantee your audience will be interested in your specific NFT project. Liverpool, with 35.2m Instagram followers, sold “less than 10,000 of the 171,000 NFTs” six days after its initial launch. Over 95% of the NFTs were priced at $75. Professional Wrestler John Cena, with 17.4m Instagram followers, ended his NFT collection citing “We sold 37 of them. It was a catastrophic failure.” Of Cena’s NFTs, the highest tier single issue “John Cena Platinum NFT” sold for $21,000, while Cena priced the second tier NFTs at $1,000.

Even if your initial token offering is less than successful, there are still customers who hold your NFT assets, and expect that the NFT product has a long lifetime and continuous technical maintenance. How does your organization NFTs deal with this situation?

What do digital implementing partners think about NFTs?

NFTs are also highly controversial in the gaming space, where some gamers view NFTs as an over-extension of micro-transactions, where game publishers force gamers to pay continuously for features that gamers already expect in the game. Electronic Arts, makers of the FIFA video game series, has downplayed its interest in NFTs following public backlash, and Microsoft, Epic Games, and Valve have all said they will not embrace NFTs in games. Valve is not just game publishers, they also own a significant PC game store: Steam. However, Ubisoft, makers of the eSports title, Tom Clancy, have pushed on with an NFT offering despite public-backlash. As sport organizations look for more digital partners, it’s important to consider that not all game publishers are currently supportive of NFTs.

Does your audience consider the NFTs an investment?

A major source of the interest in NFT’s investment potential. News media often reports NFT’s success as in their final sales price, rather than the number of bidders or other measures of engagement.

In 2021, McKinsey & Company found NFT sports buyers broke down in 35% Speculators, seeking financial return, 22% tech lovers, who were passionate about the NFT technology, 20% collectors, who appreciate NFT art, and 24% community members, who used sports NFT to become more involved in their favorite sport. McKinsey also found that 10% of NFT buyers accounted for 67% of the total spend. These buyers view NFTs “as a way to make a lot of money”. However, few other NFT buyers, “39% of the Collectors, 28% of the Community segment, and 41% of the Speculators” bought cryptocurrency.

Organizations launching NFT products should consider: How will your bifurcated market function? (where some purchase NFTs for fan engagement and some purchase for investment) Will this cause your audience to view an initial token-offering as an opportunity as a quick revenue boost or authentic fan engagement?

What are your long term-relationships with this NFT service?

NFTs are emerging technologies which will continually evolve and mature. Sports organizations considering NFT partnerships should be mindful of future technological and organizational driven change.

What happens when a sports federation wants to dissolve the partnership?

Even if the initial sale of NFTs is successful, it’s important to consider what will happen when your organization would like to stop its NFT partnership.

Besides Formula 1’s, America’s Major League Baseball (MLB) canceled its NFT video game project. In 2021, the MLB shutdown its MLB Champion NFT fantasy baseball game launched in 2018 by Lucid Sight, Inc. At the time of closure, it was the fourth most popular sports project on OpenSea. Lucid Sight and MLB offered limited public comments about the termination reason. After the closure, the MLB signed a new NFT partnership with Candy Digital Labs.

In January 2022, NBA star De’Aaron Fox launched his SwipaTheFox NFT project, with 3,000 people signing up and raising about $1.2m. However, in February 2022, Fox canceled the project stating that “the time and attention that y’all drive and that I wanted to give you all/what this project requires, was not known to me and I overstepped and stretched myself too thin, trying to do this project in the middle of the NBA season.” Following the closure, relevant social media accounts and web domains were deleted, and the funds were drained from the wallet with only limited investor reimbursement. In the 90 days post closure, these NFTs lost 96.5% in value.

In both situations, the negative public reaction fell on the sports organizations, who actively shut down the NFT project. The rapid announcement shutdown contributed to the negative public reaction, who felt that the “rug was pulled out from them.” There is a significant unknown reputation risk when entering the NFT world.

What is your policy for transferring blockchain technologies and providing continuous support?

Organizations and publishers should consider their policies for continuous NFT support or migration to another NFT platform.

Currently, the two most popular NFT marketplaces: Rarible and OpenSea’s focus on the Ethereum blockchain. Ethereum is a dominant blockchain technology, used in crypto and NFTs, but faces significant public pressure for its ecological impact. Decreasing ecological impact is one of drivers for new blockchains, such as Polygon. Currently, it is possible to migrate NFTs based on the Ethereum to Polygon block-chain, but nothing guarantees future token interoperability.

NFT’s as marketed as intangible long-lasting assets, similar to traditional art, which might last forever. However, NFTs, as all digital assets, are vulnerable because they must be stored digitally. As Verge reports, there is very little detail hosted directly on the blockchain. Block-chains usually store directional data while the artwork could be hosted on traditional URLs. “Traditional URLs pose real problems for NFTs. The owner of the domain could redirect the URL to point to something else (leaving you with, perhaps, a million-dollar Rickroll), or the owner of the domain could just forget to pay their hosting bill, and the whole thing disappears.” In the future, it is very possible that if NFTs are not maintained, NFTs will point to missing files, and it will be very difficult to recover art or prove ownership.

What are the norms & regulations surrounding NFTs?

Crypto-currency, NFTs, and other blockchain assets are a loosely regulated markets facing increasing government scrutiny. Organizations should be mindful that they are currently launching NFTs when regulation is playing catch-up.

In the European Union, the pending Markets in Crypto Asset Regulation (MiCA), introduced in Sept 2020, could have potential NFT-regulated market regulatory powers. The MiCA proposal was the European Union’s first time defining a crypto asset, as a “digital representation of value or rights which may be transferred and stored electronically, using distributed ledger technology or similar technology”. The MiCA proposal contains different requirements and operations for three major categories of tokens, where NFTs could fall into the broadcast “other crypto-asset category.”

In the United States, NFTs currently occupy a gray-zone of regulation, fraught with potential lawsuits. In May 2021, Dappar Labs faced a class-action lawsuit, alleging NBA Top Shot was sold as an unregistered security. The lawsuit is still in the court system. The American regulatory bodies are particularly interested in the concept of fractional NFTs, where ownership of NFT represents partial ownership of a larger asset. Additionally, pre-selling game NFTs, in order to raise funds to build the game, risks American securities regulations.

Conclusion:

NFTs are a significant fan engagement and revenue stream opportunity for sports organizations and athletes. However, it is important to consider a strategic long-term product life-cycle mentality, beyond the initial launch, that plans for the long-term maintenance, transfer and end of an NFT product.

This article is written by the Class of 2022 Kevin Fulgham.

View Kevin’s profile