Why aren’t OTT platforms the market disrupter that they were supposed to be?

“Absolutely, I think they [Facebook, Amazon] will enter the mix; anecdotally, there was incredibly strong interest in the last cycle. I do think we are going to see an increasing engagement from these and we would welcome the interest.” This quote comes from Ed Woodward, former CEO of Manchester United. He suggested in a meeting with his former shareholders in 2017 that Facebook and Amazon will finally enter the race for premium sports rights, outbidding the until now traditional bidders, broadcasters, and telcos.

Did Woodward have factual information about Facebook and Amazon’s interest? Or was it a publicity stunt to increase bidding competition to realize a higher value for his teams’ broadcasting rights? It is hard to say, but what we do know is that technology heavyweights like Facebook and Amazon, as well as OTT – an acronym for “Over-the-top” and refers to the content offered directly through the internet – newcomers like DAZN, are more frequently joining the sports rights conversations. What remains to be seen is these newcomers’ ability to effectively monetize rights to justify the high purchase prices.

The sports media ecosystem has historically relied on a relatively simple model – broadcaster buys rights for X amount and monetizes the rights for more than X amount through advertisements displayed to their large audiences. However, shifts in consumer behavior and an increasingly competitive entertainment landscape are challenging the traditional model, making it more difficult for rights buyers to effectively monetize.

This shift has created high expectations for new OTT players with an innovative distribution model that addresses the changing consumer behaviors. In his book named “Business of TV Rights in Football”, Pierre Maes explains in 2018 that looking at the success of Netflix, everyone in the sports media industry predicts the rise of OTT platforms and the death of the traditional media (here implied linear TV broadcasting).

Nevertheless, to date, these companies’ ability to live up to the expectations is in question as they have not disrupted the space as many thought they would. Though Amazon has purchased high-profile sports rights more recently, GAFA remains largely on the sidelines. DAZN, an OTT provider that has recently purchased a string of high-profile rights including a multi-year deal with LaLiga, recently had to raise $4.3 billion to sponge debt. So, what is preventing these companies from delivering on the promise of industry disruption?

What are the challenges:

OTT platforms face several challenges preventing them to gain the full value of the rights they own. A key piece to look at is the subscription-based model currently set in place by many OTT platforms. This model encounters itself with the reality of high customer churn. Although the companies don’t share financial details, we can quote the FuboTV platform presenting operating loss in Q3 of 2021 of 103 million dollars. DAZN recently published numbers for 2020 with losses of 1.3 billion for 2020. Covid created obvious challenges in 2020 as only limited sporting events were delivered. However, 2019 can serve as a more accurate depiction of reality with a 1.4 billion dollar loss as well.

On top of that, OTT platforms are facing technological issues since the distribution model is completely different than that of traditional broadcasting. One of the most representative examples has been the first Serie A game day of the 2021/2022 season where viewers reported “buffering, signal instability and poor video quality.” To ensure a smooth and enjoyable viewing experience, OTT platforms must ensure the same delivery quality viewers receive while viewing over linear TV.

Despite the best efforts from companies like Deltatre using cloud-based technology like Amazon Web Services, this remains a significant challenge. For example, 112.3 million people tuned recently to watch live the 2022 Super Bowl between the Rams and the Bengals. Out of these 112.3 million viewers, 11.2 million were from NBC’s OTT platform, Peacock. The doubt remains if the 112.3 million could have watched the game with no technological issues at the same time on Peacock.

Moreover, piracy is another challenge to take into account. As per a recent study made by Synamedia and Ampere, sports rights holders are missing out on US$28.3bn a year due to piracy while OTT platforms could gain US$5.4bn by eradicating piracy. The fragmentation and the distribution model make it easier for pirates to gain access to the streams from appropriated platforms.

Finally, another key challenge is that sports OTT platforms are likely to not work as a stand-alone offering, betting solely on sports rights. Sports content offering is seasonal by nature which means that customer acquisition and most importantly retention will be of the utmost importance in that regard. Sports streaming platforms will need to bet on product differentiation to prevent churn. In that context, premium domestic rights seem to be a strong customer acquisition strategy.

On the other hand, new revenue streams such as NFTs, betting, e-commerce, non-live sports content, or even gaming can be perceived as customer retention tools that are important to further invest on as explained by Kevin Mayer, chairman at Dazn. In that sense, we have even seen Netflix, one of the most profitable streaming platforms entering the gaming world as it seeks (or feels the need?) to diversify its revenue streams.

What now?

As previously shown, OTT platforms present empirical difficulties in their implementation and raise doubts about their profitability in the sports live streaming space. However, streaming platforms offer a direct-to-consumer approach highly valued by companies nowadays.

The D2C strategy offers close proximity with the fan that the unilaterality of linear broadcasting has never been able to propose. In an era where prospective viewers are tougher to reach and have increasingly high expectations of the content they want to watch, this model is highly attractive from a marketing perspective.

Gaming platforms such as Twitch have embodied this strategy and have given access to content creators to exchange directly with followers to market and monetize different products and services. The number of monthly broadcasters on Twitch nearly doubled in 2020, from 3.6 million to 6.9 million which proves the attractiveness of the model even more to reach and impact a younger audience.

The younger audience is another key variable in this debate. Indeed, there is a strong shared concern from the sports industry as a whole that the audience interest is waning, the fan base is ageing, and there is an explosion of competitive entertainment offerings. All of these challenges make it difficult for sport to maintain the standards of excitement that have made its success.

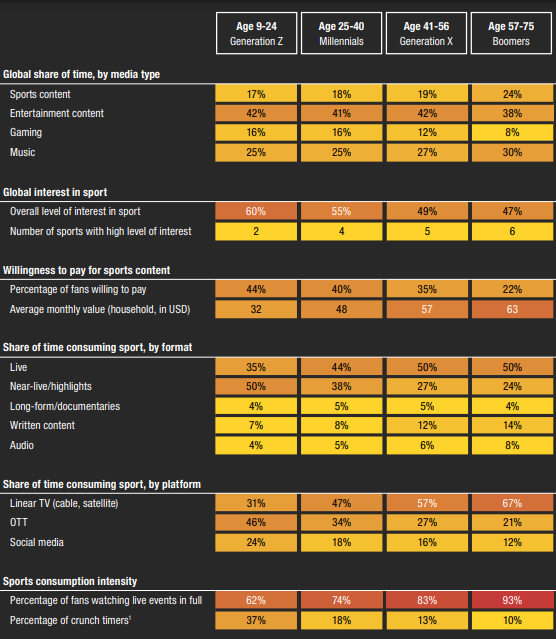

Here, the numbers provided by the PWC sports report show that out of all the demographic groups, gen zers are the ones that spend the most time on OTT platforms, followed by millennials (46% vs. 34%).

In the table above, we can see the fan behavior consumption behaviors dividing them by demographic groups. The share of time consuming sport by platform is what truly interests us with a clear majority of younger demographics attracted to the OTT model. This shows future potential in growing numbers of subscribers with a more complete and diversified offering. Moreover, technologies should keep improving making streaming platforms more appealing.

What about the GAFA(NT)

GAFA stands for Google, Apple, Facebook, and Amazon. This acronym has the purpose to identify these four tech giants as an entity. You could probably guess that Netflix and Twitch are the two added letters at the end. They are of relevance as Twitch has already made some moves in acquiring sports rights and Netflix announced that they would be open to acquiring F1 rights with the very popular documentary “Drive To Survive” attracting huge audiences.

Twitch is not the only tech company that has invested in some shape or form in sports rights. Facebook has streamed the UEFA Champions League in some markets, YouTube has been streaming live the women’s champions league, Amazon is currently broadcasting the NFL and Apple purchased the rights of the MLB to stream on their Apple TV service which shows a sign of willingness from one of the wealthiest companies in the world to enter this space. However, there isn’t a strong and consistent willingness to bid for major rights. Why not?

Peter Hutton, head of sports at Meta said it best back in 2019: “Facebook talks a lot about product-market fit – a lot of testing and, if we find a product-market fit, we will invest further in that idea – and I think that sums up where we are in sport”. The truth is that the tech giants have shown an undoubtable interest in sports but are yet to understand how much it can help them in their growth.

Fast forward to 2021, and Rob shaw’s interview to Sports pro: “We did a tremendous amount of experimentation and learned a lot about what happens if you put a live event on a social platform […] There is a pretty big business opportunity in going live on our platform but it’s for the publishers, not for us”. It seems that after a testing period, Facebook (or Meta) hasn’t found the right model yet. Nevertheless, they show commitment in being there for sports, clubs, and publishers but supporting them rather than streaming directly the rights on their platform.

Though consistent purchases by the GAFAs are yet to happen, there is evidence they will jump on unsold rights for a bargain as a low-risk opportunity to test. The French Ligue 1 rights were picked up by Amazon at a terrible moment for the league after their previous deal with MediaPro collapsed in 2020. Although there aren’t any numbers to show if the deal is being successful or not, Amazon got a much-appreciated boost when two months after the acquisition of Ligue 1 rights, Lionel Messi signed for the club.

Sometimes, the rights are bought for more than simply profit. For example, Facebook bought La Liga rights in India not necessarily to have a return on investment but rather to attract more people to the platform in a strategic location (India and its 1.38 billion people). However, this strategy to acquire sports rights to further support a primary business is one that is leveraged infrequently, which contributes to ongoing doubts as to why GAFAs are not making more aggressive moves in the space.

Pierre Maes in his book gives us a piece of the answer: “They do not seem to have a clear view yet on how to make their investments in sport profitable and proceed by trial and error at a lower cost.”

The answer lies in the monetization part of the business. Sports rights are expensive and these platforms are usually subscription-free and therefore haven’t found a proper way to monetize live sports content in a profitable manner, or at least not in a scalable way.

Rob Pilgrim, Youtube head of sports for EMEA confirms the explained theory: “YouTube has always been an advertising business at our core but we have recognized that partners and creators have asked us for new ways to monetize”.

Conclusion:

As we have seen, the challenges are manifold, depending on what angle we look at them. However, in a sports ecosystem that is heavily funded by broadcasting rights, (73% for IOC, 86% for UEFA), failing to increase or at least maintain the value of the rights can be seen as financially concerning for many organizations. Simply put, a whole ecosystem relies on these sales.

Therefore, it is in the rightsholder’s interest to have more potential buyers, as competition increases the value of the rights. However, broadcasters are facing more and more difficulties to deliver content that creates a profitable return on investment, as exemplified by the latest joint venture between Discovery and BT. Therefore, monitoring the growth of OTT platforms becomes vital for the whole sports ecosystem.

Although OTT platforms have not disrupted the sports industry at the pace they were predicted to, it does not mean that they won’t play a major role in the future.

As depicted in this article the success of streaming platforms can be explained by two main factors: attractiveness towards younger audiences and direct to consumer offering. The challenges that lay ahead are certainly not easy barriers to overcome, but the hope is that the right monetization model that is sustainable and profitable can be applied to these platforms.

New technologies as well as consolidation of existing ones will offer the viewer a more appealing user experience and may even eventually bypass one day traditional TV. We don’t know what tomorrow will be made of but one certainty remains, OTT platforms are here to stay.

This article is written by the Class of 2022 Daniel Dos Santos, and Andrew Koch co-author of this article.